Vantage Mobility International (VMI) is proud to announce an agreement with Bank of America® (NYSE: BAC) that will make it easier for consumers nationwide to apply for financing of wheelchair-accessible vehicles. Approved applicants can use their loan to purchase a new wheelchair van at VMI dealerships anywhere in the United States.

Under the agreement, consumers get:

- Direct access to Bank of America financing options via a link on the VMI website

- Competitive interest rates and terms up to 72 months with approved credit

- A decision within minutes of applying for a loan

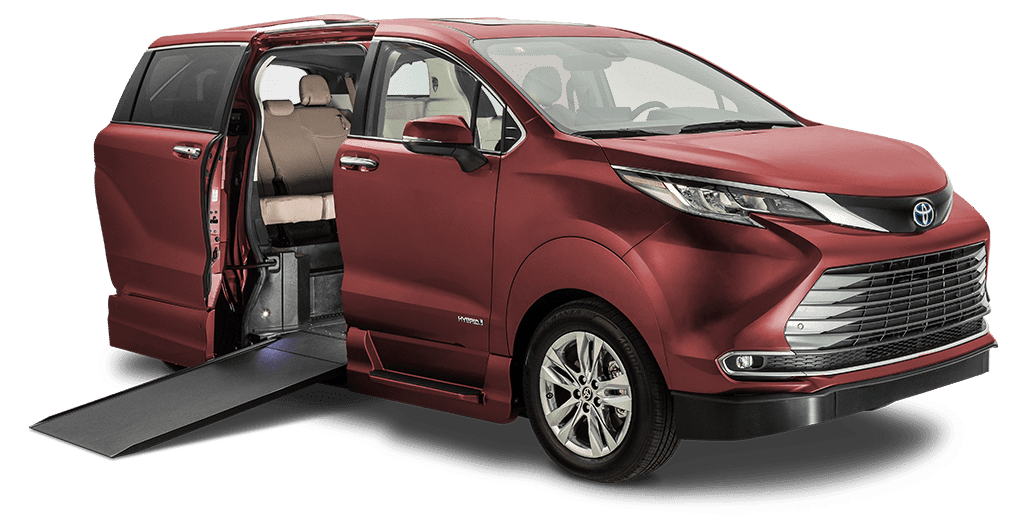

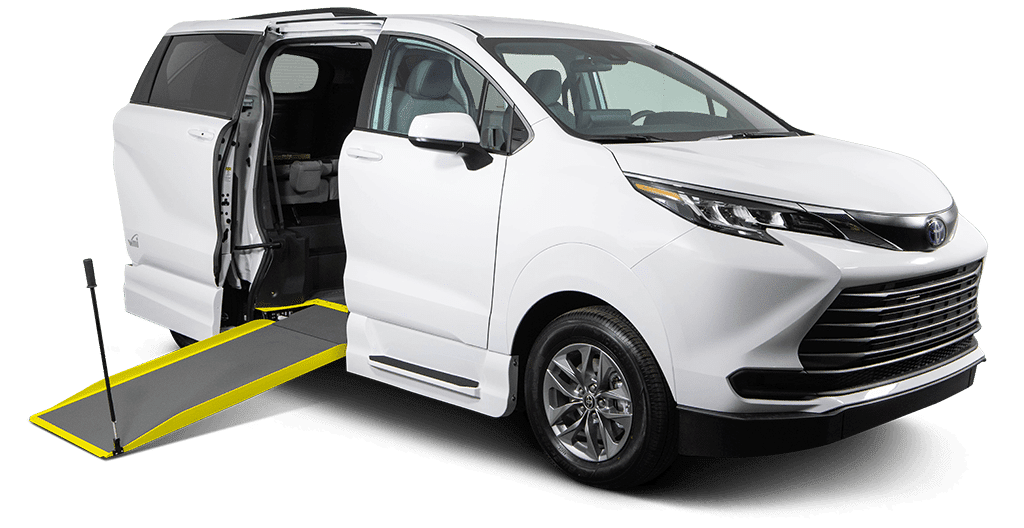

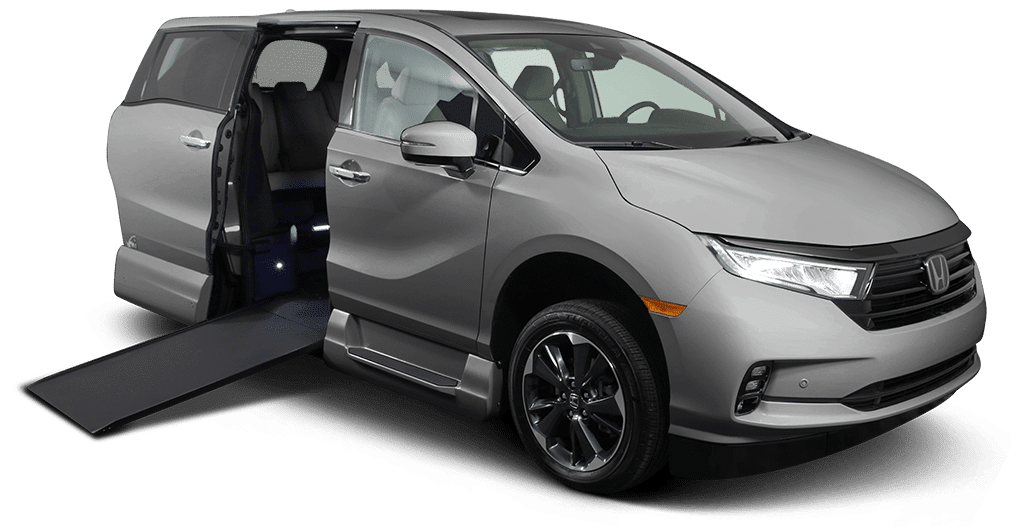

“With Bank of America’s support, VMI will help even more people regain their independence,” said Doug Eaton, president of VMI. “Customers with approved credit can now fast track delivery of their Toyota®, Honda® or Chrysler® minivan with a VMI ramp conversion. This is a major step forward for the mobility industry and, most importantly, a tremendous victory for people with disabilities.”

This new financing program simplifies the buying process with three easy steps:

- The customer chooses the right VMI Toyota, Honda or Chrysler wheelchair-accessible vehicle that matches their specific needs and budget.

- Then, the customer navigates to Bank of America’s loan page using the link on the VMI website to complete the Direct Lending Application. Most approvals come within 15 minutes of application.

- Lastly, approved customers receive a call within one hour, with the option to speak with a loan officer for details and explanations. At this point, customers can also estimate their monthly payments by using the easy online calculator on VMI’s website.

This new agreement between VMI and Bank of America came about because VMI has been trying to form a relationship with a national lender to give consumers a new financing option.

“A large percentage of wheelchair-accessible van purchases already involve financing, yet sources have primarily been limited to local or regional institutions,” said Tim Barone, VMI CFO and partner. “The Bank of America finance team took the time to really understand our business and consumer. They provided tools and resources beyond credit to help us enhance our processes and customer loyalty.”